The client is a mid-sized mortgage services provider based in Atlanta, GA. With operations across multiple states and a growing loan portfolio, the company manages a range of customized loan programs catering to homebuyers, property investors, and condominium buyers.

The firm employs 100-150 professionals, including a team of Loan Officers who act as the first point of contact for borrowers. The client is recognized for offering flexible portfolio loan programs with complex eligibility rules and documentation requirements.

Given the nature of their work, the company deals with frequent updates to program guidelines, regulatory compliance, and strict service-level expectations. Their sales and operations teams often struggled to keep up with changing policies and respond to borrower queries efficiently.

The client approached Flatworld.ai with a clear but complex objective: to enable its Loan Officers to quickly access the most up-to-date information on various portfolio programs and condo requirements without having to dig through static documents or rely on manual back-and-forth with internal support teams.

Flatworld.ai followed a phased approach that allowed rapid prototyping, real-time feedback incorporation, and smooth deployment on the client's existing infrastructure.

The team aligned with key stakeholders to define business goals, capture technical constraints, and establish the deployment environment. Clear timelines and role ownership were established at this stage.

A functional prototype of the AI assistant — customized on top of the Telena framework was developed. This included setting up intents for common loan queries and drafting sample email templates for escalation.

Telena was trained on the customer's program guidelines. To enable fast and context-aware responses, Flatworld.ai integrated vector search technology for retrieving unstructured documents. The chatbot widget was customized for compatibility with Wix and WordPress and embedded on the client's internal portal.

Flatworld's team ran prompt tuning exercises and tested Telena with real queries from Loan Officers. The model was repeatedly refined to improve its handling of tabular data like rate charts and program matrices.

Internal QA was followed by user acceptance testing with the client's team. Feedback was collected around response accuracy, response tone, and coverage of edge cases.

After going live, Flatworld.ai provided user training sessions and shared quick-start guides. The team monitored live usage for two weeks to ensure a smooth transition and performance stability.

While the project stayed on track in terms of timeline, several technical and operational complexities had to be addressed by the Flatworld team:

Post-deployment, the client reported significant gains in operational efficiency and sales productivity.

With Telena live on their internal portal, Loan Officers ask detailed program questions and get instant, accurate responses. This replaced manual searches through static PDFs and reduced reliance on underwriting teams. Loan Officers are now better equipped to respond on the spot, improving speed, consistency, and borrower confidence during every conversation.

Flatworld.ai helped the client convert complex program documentation into a live, searchable knowledge assistant. This shift not only improved operational speed but also reduced compliance risks and allowed the business to scale support without increasing headcount.

The Telena implementation shows how conversational AI can turn internal knowledge into a strategic advantage for modern mortgage firms — schedule your demo today.

Mortgage firm cut response time by 80% and tripled conversions using Telena AI for program queries.

Know More

Mortgage lender automated document indexing with MSuite, achieving 80% time savings and 99% classification accuracy.

Know More

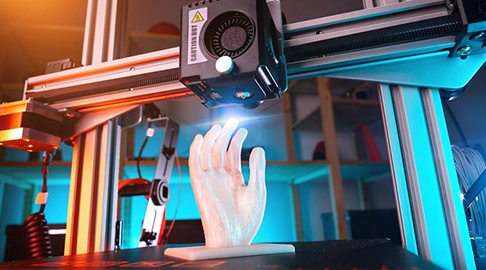

3D printer brand automated 90% of support emails with Telena AI, achieving over 85% CSAT score.

Know More